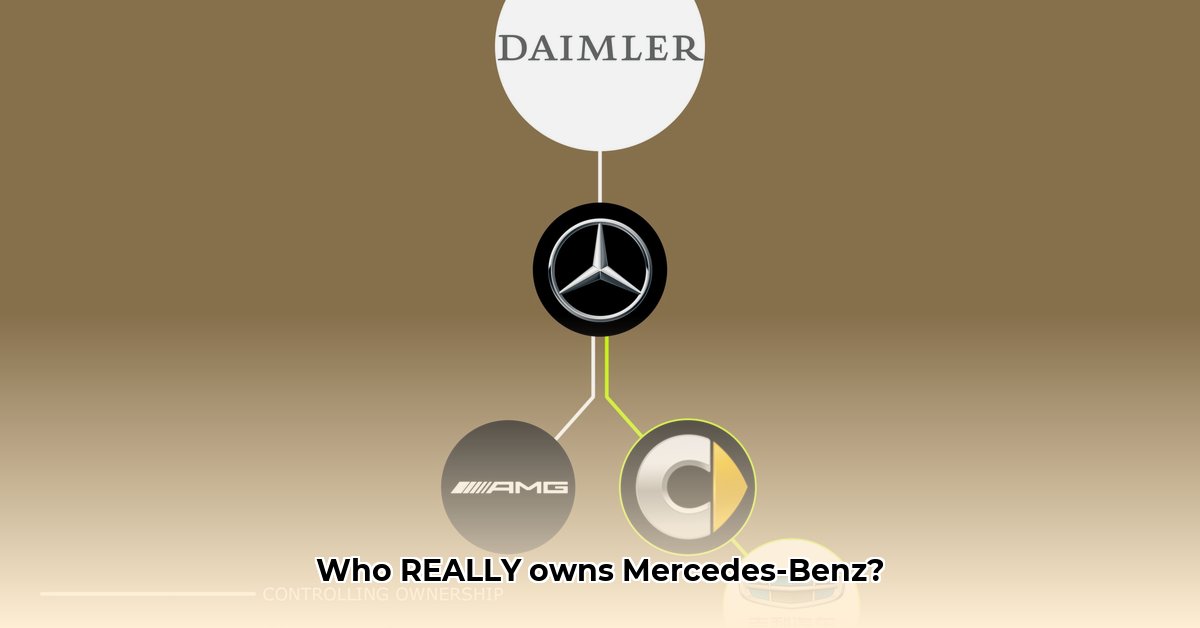

A Fragmented Ownership Landscape

Mercedes-Benz Group AG boasts a highly complex ownership structure, far from the traditional family-controlled model. Instead, a diverse array of stakeholders hold significant shares, influencing strategic decisions and shaping the company's future trajectory. This includes substantial holdings by Chinese state-owned entities, institutional investors, and individual shareholders. Understanding this intricate web is crucial to appreciating the forces driving Mercedes-Benz's strategic choices, particularly its ambitious electric vehicle (EV) transition. How do these diverse interests align (or clash) in the face of such monumental change? For a deeper dive into Mercedes-Benz ownership, see this detailed analysis.

Key Players and Their Influence

The presence of significant Chinese state-owned entities within the Mercedes-Benz ownership structure warrants close examination. Their considerable holdings grant them substantial influence over the company's strategic direction, reflecting the paramount importance of the Chinese market to Mercedes-Benz's global success. This influence extends beyond mere financial participation, encompassing considerations of geopolitical factors and local market regulations within China. Concurrently, well-established institutional investors, such as pension funds and investment firms, hold notable stakes, bringing diverse perspectives and priorities to bear on decision-making processes within the company. The Kuwait Investment Authority, though gradually reducing its stake, continues to contribute a significant, if diminishing, voice.

The Electrification Imperative: Navigating Conflicting Priorities

The ongoing shift to electric vehicles presents Mercedes-Benz with both unprecedented opportunities and considerable challenges. Massive capital investments are required to develop new technologies, establish robust charging infrastructures, and adapt existing production facilities to EV manufacturing. This poses a critical question: How do the numerous, often conflicting, priorities of Mercedes-Benz's diverse shareholder base reconcile with the demands for substantial investment in this transformative shift? Will the short-term profit focus of some shareholders clash with the long-term vision of EV adoption, necessitating strategic compromise and nuanced communication?

The substantial investment undertaken in expanding EV production capabilities, such as the upgrades at the Stuttgart-Untertürkheim plant, underscores the company’s commitment to this electrification. However, even such decisive actions remain heavily influenced by the varied interests and expectations of the company's extensive shareholder base.

The Double-Edged Sword of Diverse Ownership

A diverse investor landscape offers both advantages and disadvantages. The myriad perspectives can foster financial stability and provide a broader range of insights. However, this plurality can also lead to disagreements over resource allocation, strategic direction, and the velocity of transitions like the shift to electric vehicles. Internal debates regarding research and development funding, geographic expansion, and the pace of EV adoption are inevitable consequences.

Unpacking the Power Dynamics

Precisely quantifying the influence of each major stakeholder remains a significant challenge. The distribution of voting rights and the mechanisms through which shareholders exert their influence are not always fully transparent, adding an element of ambiguity to the analysis of Mercedes-Benz's ownership structure. Transparent communication between management and its investors is crucial for maintaining a cohesive approach to navigating this potentially fragmented landscape.

Charting a Course for the Future

Mercedes-Benz's long-term success hinges on its ability to skillfully manage the competing expectations and influences of multiple stakeholders. Effective communication, strategic alignment, and transparent practices are fundamental to navigating the complexities of this ownership structure. Maintaining a cohesive vision among disparate interests will prove crucial in securing the brand's continued prosperity within an increasingly competitive global automotive market. This requires a delicate balance – fostering a shared understanding of the company’s strategic goals while addressing individual shareholder concerns.

Simplified Ownership Structure: Key Stakeholders and Their Influence

| Stakeholder Category | Impact on Mercedes-Benz Strategy | Strategic Considerations for Mercedes-Benz |

|---|---|---|

| Chinese State-Owned Entities | Significant influence, particularly regarding the Chinese market and governmental regulations. | Maintaining strong relationships, adapting to Chinese market dynamics, and aligning with local regulations. |

| Kuwait Investment Authority | Notable influence (though decreasing), with a focus on long-term financial returns. | Maintaining transparent communication to build confidence and demonstrate strong potential for returns. |

| Institutional Investors | Collective influence shaped by market trends and individual investment strategies. | Understanding market sentiment, meeting diverse shareholder expectations, and clearly articulating the long-term strategic vision. |

| Individual Shareholders | Combined influence indicating overall investor confidence. | Fostering broad trust and maintaining transparent financial reporting. |

This analysis offers a simplified view of the intricate ownership structure at Mercedes-Benz. The interplay among these stakeholders will continue to evolve, significantly shaping the company’s future direction. Keeping abreast of these developments is crucial for understanding the company’s strategic maneuvers in the dynamic global automotive industry.